DST 1031 Exchange

Are you thinking about executing a 1031 exchange?

You may want to consider utilizing a Delaware Statutory Trust (DST) for your replacement property. Replacement properties structured as DSTs have become a popular vehicle for 1031 exchange investors for a number of reasons and we’re here to help you understand why.

Benefits of a DST

A DST is a unique structure because it allows multiple investors to purchase fractional ownership in an institutional quality asset.

DST Scenario

DST 1031 Exchange offers a unique multiple investor structure.

1. No Management Responsibilities

Relieve yourself of the hassles, headaches and responsibility of managing properties. Investors benefit from professional real estate expertise provided through the DST structure. They will take care of the acquisition, financing, property management and asset management.

2. Monthly Cash Flow Potential

Most DST investments are designed to provide cash flow on a monthly basis to investors.

3. Limited Personal Liability

If the DST has leverage, the loans are non-recourse to the investor. This means they should not impact the ability of the investors to secure future loans.

4. Fractional Ownership

Because investors are buying a fractional ownership, the dollar amount of replacement property can be lined up with the amount of relinquished property. Additionally, fractional ownership makes it easy to use a DST as a part of an exchange. For example, if an investor finds direct real estate for a portion of their exchange they can use a DST for the remainder.

5. Estate Planning

As with all 1031 exchange investments, under the current tax law, beneficiaries will receive a step up in basis upon the death of the investor. Additionally the DST provides heirs with professional real estate management rather than the complications of hands-on management, which can be further complicated by multiple heirs.

6. Access to Institutional-Quality Property

The fractional ownership structure of DSTs allows investors the opportunity to invest in multi-million dollar, institutional-quality properties that would be out of reach for most real estate investors. Additionally, these investments have gone through thorough due diligence.

7. Diversification

Because of the low investment minimums (often times as low as 100K), investors can divide their investment into multiple DST offerings. This allows investors an opportunity to diversify their investment geographically, by property type and by sponsor.

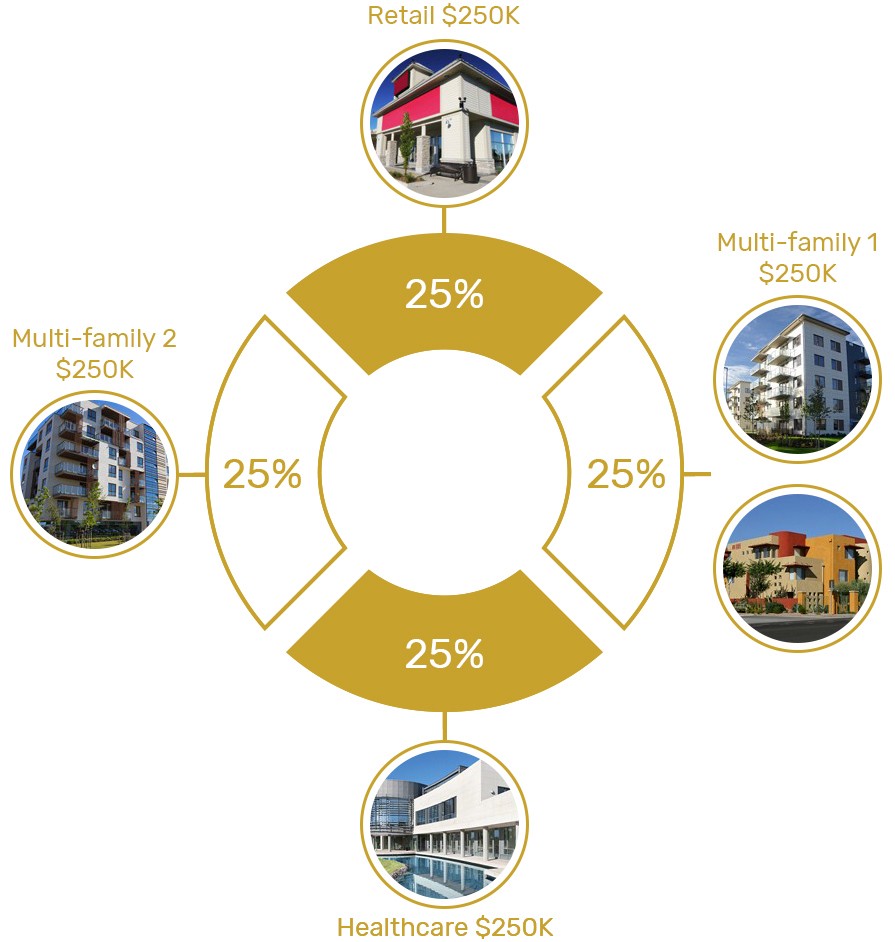

Hypothetical Illustration of $1,000,000 Allocation

Diversified with Different Asset Types

DST 1031 exchange investments offer the benefit of diversification.

DST Risks to Consider

While DSTs are a very popular and often appropriate investment vehicle for 1031 exchanges, they are also not for every investor. DST risks to consider include but are not limited to: the actual amount and timing of distributions is not guaranteed and may vary. In addition, investors’ capital is not guaranteed. These investments are generally not liquid and may have declining market values and tenant vacancies. Therefore, investors must carefully consider their overall financial situation prior to investing.

Get Started

In a 1031 exchange scenario, we at Chicagoland 1031 Exchange, will first help you determine which investment approach and options make sense for your unique situation. If, after our guidance and education, you choose to pursue a DST, we will provide you with access to investments from a number of sponsors who offer replacement properties structured as Delaware Statutory Trusts (DST). Together, we will review a variety of potential replacement properties—including triple net, Multi-family, office, retail and medical properties, and more—and we will help you select a replacement property(s) that fulfills your exchange requirement and is in line with your financial goals.

If you are looking for an exchange replacement in excess of $3 million, please reach out to us directly for customized offerings.