1031 Exchange

Is a 1031 Exchange Right for You?

If you’re considering selling property and want to defer, or even eliminate, the taxes that may arise from the sale of the property, a 1031 exchange may be an appropriate solution. We are 1031 exchange professionals, assisting clients nationwide for the last decade. We are here to help you find clarity in the 1031 exchange process.

Potential 1031 Exchange Benefits

A properly executed 1031 exchange may provide a number of benefits, including:

Defer Taxes

By completing a 1031 exchange, potential taxes on the sale of the property may be deferred (e.g., capital gains, depreciation recapture).

Preserve Capital

A completed 1031 exchange may provide the opportunity to put all capital to work rather than lose a portion of it to taxes.

Generate Cash Flow

Depending on the type of replacement property purchased, the potential for consistent cash flow may be a benefit.

Diversify Portfolio

Passive ownership structures allow for diversification both geographically and by property type.

Passive Ownership

Structures such as TICs and DSTs allow for passive ownership, alleviating the worry of managing a property.

Facilitate Estate Planning

DST and TIC structures allow for a step up in basis upon death, may facilitate intergenerational planning, and protect family interests.

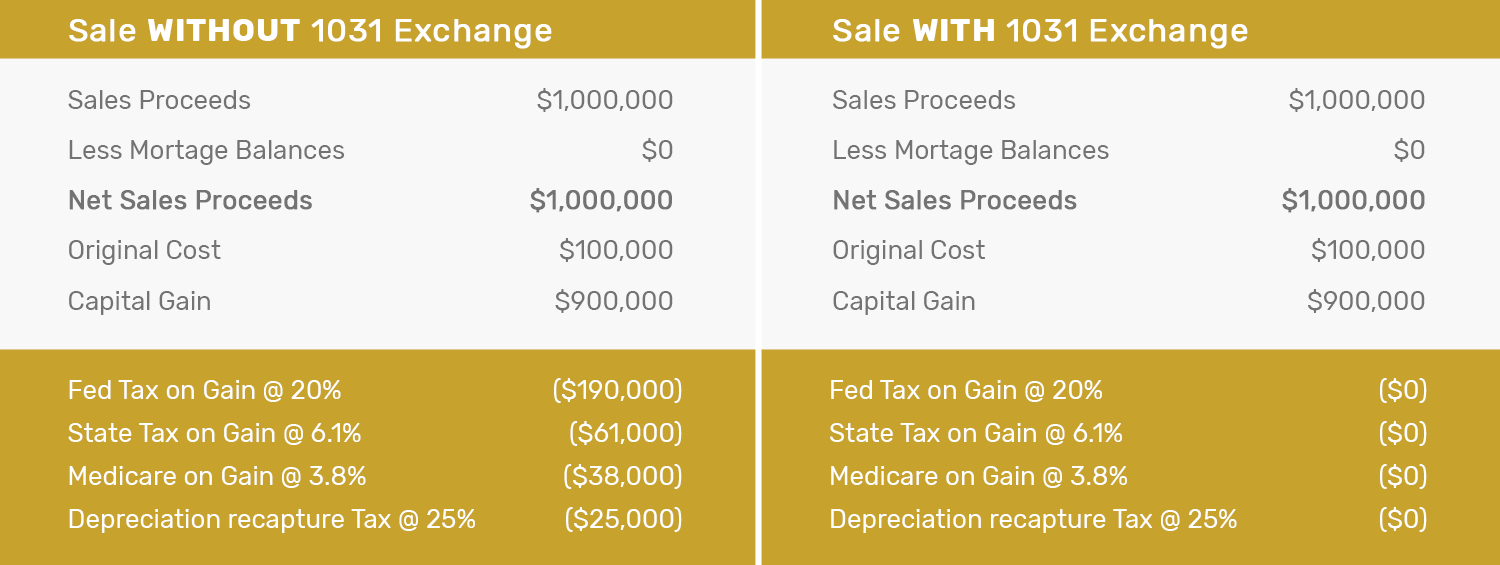

Hypothetical 1031 Exchange Transaction

Hypothetical 1031 Exchange Transaction. For example purposes only. Actual results may vary.

Navigating a 1031 Exchange

The rules and timelines that must be followed for a 1031 exchange are complex and may feel overwhelming to complete without professional guidance. Given the financial magnitude of your investment, you will want to be sure you’re investing with thought and clarity, and that you understand all of your options. That’s why we’re here. We will help make sense of the process and guide you through the exchange so you can walk away feeling confident you’ve made the right decision.

At Chicagoland 1031 Exchange we pride ourselves on our personal touch. Throughout the 1031 exchange process, we will:

- Provide you with education and advice on your 1031 exchange in a way that takes into account your individual situation rather than a formulaic response.

- Review replacement properties together from a number of sponsors that have gone through our due diligence process.

- Coordinate with other professionals you are working with regarding your exchange, including your accountant, attorney and realtor.

- Take the time to answer any and all questions you have regarding your exchange and investment.

We have completed 1031 exchanges for a wide variety of clients including farmers and ranchers who have sold their land, individuals who have owned rental property and are now ready to take a more passive approach to owning real estate, small business owners, and professional real estate investors.